Now that may seem an unlikely title for someone writing about investments, but to be clear, this blog is called Money Matters. And money does matter! As you know if you're reading this, I follow the stock market, and find it fascinating. I have educated myself relative to investing for maximum returns in our retirement funds, so maybe my husband won't have to work forever.

What piqued my interest to look at personal income taxes over the past century taxes was a YouTube video made by author Robert Reich (Saving Capitalism: For the Many, Not the Few, 2015. I know nothing about this book whatsoever and am not here to sell it. Click on Kirkus review and/or Amazon for more info). Reich served under Presidents Ford (R), Carter (D) and was Bill Clinton's (D) Secretary of Labor from 1993-1997.

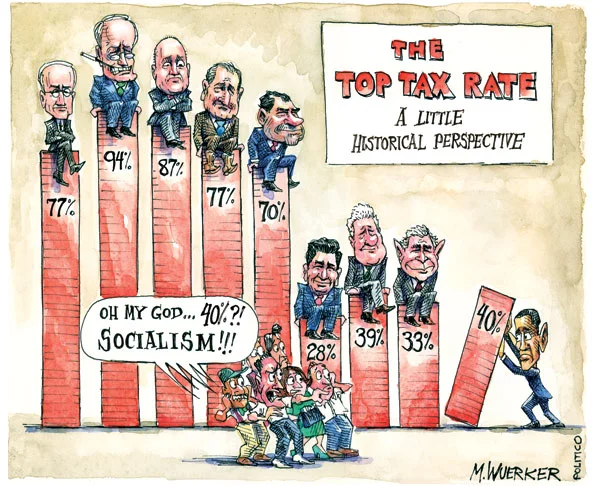

Recently a Facebook friend posted the video, and it showed a cartoon illustrating the top tax rates on individuals under various presidents. I could not believe my eyes. I looked into this more fully to satisfy my own curiosity, and found info going back to 1913. Then I looked into it in more depth. It was like opening a can of worms. How our nation has looked at wealth and taxes over the past 100+ years is quite revealing.

Here's the political cartoon by M. Wuerker that caught my eye:

Before I begin, I should make a few things very clear: First, This article is not intended to comment on the 2016 candidates for president. You have to draw your own conclusions relative to that circus. I hope Republicans and Democrats alike will read this and perhaps reflect on the implications of what the history of tax rates says say. Numbers, you ask?

Second, I like numbers. That's not a secret if you know me. Numbers are clean, honest and not subject to opinion. Since I am highly opinionated, I like using them to make my points. Try not to glaze over in advance thinking about that.

Third: I like money. In fact, I'm a huge fan. If you don't believe me, take a look at the rest of this website. Anyone who says money doesn't matter is frankly only fooling themselves with idealized, romanticized notions. I've been on the border of poor and now I'm comfortable. Comfortable is a lot better. I would guess that being wealthy would be better still. I'd love to give it a try.

Fourth: to be perfectly blunt, I do what I can to reduce our tax exposure; we take all the deductions we're allowed to by law.

Fifth: As with so much in life, issues surrounding tax rates are far more complex than what I am presenting here. Many variables contribute to the economy as a whole. I don't get into deductions of any kind. I realize this is a simplified, highly condensed look at a long span of time. So with that, here's some all-American tax history from last 100 or so years. With my not always subtle interpretations thrown in for good measure.

American Income Taxes: A History

Norris Brown, a Republican from senator from Nebraska, first proposed an income tax amendment to the Constitution in 1909 while serving under Republican President Howard Taft. The country was still very young, and had little infrastructure. American sentiment at this time was that the wealthy should pay an income tax. Taxes had been part of American life before this time, but a new more formally structured format was seen as necessary by this time.

In 1912, Democrat Woodrow Wilson was elected president. Set in motion by the Taft administration, the 16th Amendment to the Constitution was created and adopted on February 3, 1913 shortly after Wilson's inauguration. The 16th Amendment allowed Congress to levy a federal income tax without apportioning any to the states.

In 1913 there were 7 tax brackets. At the top was an incredibly low rate of 7% on individuals making half a million dollars & up. If you made under $20,000 a year (which obviously most people did), you paid 1%. Capital gains taxes on profits from investments were taxed at a higher rate than income taxes. Government was very small and the approach was very basic. World War I changed everything. By the end of Wilson's 2nd term in 1920, personal income taxes had jumped to 73% on those making a million dollars and up. Capital gains taxes had also jumped and matched the personal income tax level. Corporate taxes were ten times higher than in`1913. Wars are expensive.

My grandfather John Wright was in the artillery in World War I. Our family believes he was 'shell-shocked' from what he witnessed in the war, a condition now called post-traumatic stress disorder. The expense of war goes well beyond the monetary.

That million dollar line drawn in the sand is the highest income tax tier. For future reference, the highest income tax tier is defined as the minimum income being taxed at the year's highest rate. So in the above 1920 example, people making $1 million made the smallest amount of money in the group paying the highest rate of 73%. The top tier tax rate was on $1 million incomes and up.

All presidential administrations have had multiple tax bracket ranges. Taxes are not set as all or nothing, but the rate is calculated on a curve depending on the family's income. I often refer to the top tier throughout this article, but bear in mind that tax ranges varied between 0-94% over this 100-year span, often with many brackets.

So you know: the USA has a marginal tax system (click on the link) What is that, you ask? It's a method of taxing income that adjusts within each bracket for fairness. The link shows how you're taxed on income increases (like that cost of living raise I hope you'll get!) within your bracket. When you hit the top of one bracket, you get nudged into the next tax bracket.

Republican Warren Harding became president in 1920, and lowered the individual tax rate gradually to a high of just around 43%. By the time he died in 1923 he lowered the tax tier to $200,000 a year. The lower the top tier is, the more people are taxed at the top rate. This is because far more people make lower incomes than do high ones. In this particular case it means that in 1923, multi-millionaires and people making $200K were seen as the same in terms of tax rates.

Harding's VP Calvin Coolidge became president in 1923. He lowered the top tax rate to 25% for people making $100K and up. So even more 'regular' people were paying the same tax rate as millionaires than under Harding. (I say 'regular', because in the 1920s $100K per year was a whole lot more money than it is today. According to the inflation calculator from the US Dept of Labor, $100K in 1926 equals a buying power of $1,340,000 in 2015. That was and is a huge annual salary by most people's definition!)

To Coolidge's credit, he kept taxes low for everyone-- including the poor. For example, if you made $4,000 or less as a married couple filing jointly in 1927 (which most people did at that time), the tax rate was 1.5%. This was considerably less than his predecessor, Harding. But make no mistake-- the Harding and Coolidge administrations offered huge tax relief to the wealthy, believing that this would help the overall economy. Interestingly, the 20s were a time when the USA became much more anti-immigration. The 2os were a time of great technological advances-- the automobile, movie and radio industries all took off during the roaring twenties. Upgrades were made to roads and electricity, as well as phone lines & things we take for granted like modern plumbing.

A few Life magazine covers from the roaring twenties!

We're setting up for the Great Depression now. Republican Herbert Hoover followed Coolidge's tax rates, and in 1929 when the stock market crashed, taxes were low a 24% on anyone making over $100K a year. That changed by 1932 when Hoover asked people earning over a $1 million a year to fork over 63% of their income to taxes. The country was in big trouble, and times were changing. The rich were asked to chip in-- big time.

Democrat 4-term-elected Franklin Delano Roosevelt had a different tax approach during the Great Depression. He kept Hoover's highest tax rate of 63% for his first few years, gradually raising the highest tax tier to 5 million dollars in 1936. These people-- the super rich-- were asked to chip in 79%. Recovery from the Great Depression was costly. But Roosevelt believed everyone had an obligation to pay taxes. Even the very poor had a tax rate of 4% from 1932-1940.

Click on the photo below for a slideshow of photos from the Great Depression-

This went on for years, with the tax rate on the wealthy gradually creeping up to 81% in 1941. That year even the least wealthy paid 10% as the nation recovered-- but then the war started. World War II created an explosive change in tax rates.

From 1942-1944, the top tax tier was lowered to $200,000, so a lot more people were taxed at the highest rate. Not only was the top tier lowered, but the tax rate for these people went up drastically: If you made over $200K in 1944, you were taxed at a staggering 94%. That's the highest rate levied in the past 100+ years. Again, war is expensive on many levels, both in casualties and in cash. FDR & Congress understood that.

To be clear, the average person in the 1940s did not pay anywhere near this amount in taxes. In both 1944 and 1945, the average family made just over $2,000 annually. These people were taxed at a 25% rate. In 1945 even those in the lowest income bracket were taxed at 23%. Taxes were very high. It was a time of great sacrifice, and everyone paid their share.

According to teachinghistory.org, only 7% of the US population was paying income tax in 1940. That number jumped to 64% in 4 short years, when more Americans paid for running and defending the nation. The people in what is now referred to as the "Greatest Generation" were asked to take ownership of investing in America. This was a defining time in history when the people of our nation came together.

Rosie the Riveter was and still is an American icon. She symbolized all the women during World War II who took jobs in factories and shipyards, replacing the men who had been sent to war.

Taxes stayed high under Democrat Harry Truman (who became president when FDR died) after the end of World War II. Taxes stayed relatively high throughout his presidency.

According to web.standford.edu, the median salary in 1950 was around $4,000 a year. What was the federal tax rate for the middle class? In 1950, a married couple filing jointly making between $4,000-6,000 a year was taxed at 26%. That's a comparable salary income to a couple making between $39,000-72,000 now. As of 2013, the tax rate on people making the same inflation-adjusted salary paid considerably lower marginal tax rate of 15%.

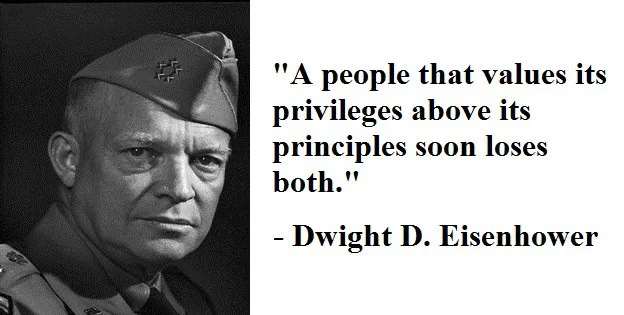

Here's where this all gets even more interesting, especially for people like me who love numbers. In 1952, Republican Dwight D Eisenhower was elected president, and from 1952 to 1960 he was our commander-in-chief. Throughout that time taxes remained stable, with the top tier paying a whopping 91% of their income to taxes. This was the exact same tax rate as during the latter part of Democrat Harry Truman's presidency.

In 1960, at the end of Eisenhower's 2nd term, the same 'average' couple was now making around $6,000 a year. Their federal tax rate was 22%. Taxes for the middle class had dropped somewhat over 10 years. But they were still relatively high-- even those in the very lowest tax bracket paid a tax rate of 20%.

That's what caught my eye. Here we had a Republican president-- but one who was not afraid to ask everyone, especially the wealthiest among us-- to help build the nation's infrastructure and preserve our nation. This is the president you may all thank whenever you use the interstate highway system. I personally remember traveling through rural Vermont to see my cousins before I-89 was built in the 1960s. The interstates transformed our nation, saving time and money for everyone.

Of course we had yet another war to pay for in the early 50s, the Korean War. Have I mentioned war is expensive?

Democrat JFK also kept this tax rate. The most famous catch-phrase of Kennedy's short presidency? "Ask not what your country can do for you, ask what you can do for your country." What a concept! It seemed to be the way of our presidents from FDR to Truman to Eisenhower, and now the youngest elected individual to claim the highest office of the land. Kennedy's taxes were undeniably high for everyone. The poorest of our nation had a tax rate of 20% through 1963.

Some faces from the 1960s, when I was a child-

Vice president Lyndon Johnson became president after the assassination of President Kennedy in 1963. In 1964 the rate dropped from a crushing 91% to 77% for those in the highest tax tier. The poorest people saw their first tax break in a long time, with the lowest bracket dropping to 16%. That rate gradually dropped for the poor throughout the mid-60s.

From 1965 (LBJ) to 1976 (Carter), the highest income tier remained at $200,000 a year. Sandwiched between these 2 Democrats were 2 Republican presidents, Nixon & Ford. The top tax rate remained close to a constant of 70% for nearly 2 decades under Democrats and Republicans alike, from 1965 until 1982. And remember-- before 1965 that tax rate on the wealthiest Americans had been even higher than that for decades!

Top Rate of Taxation of Regular Income (%)

Republican Richard Nixon became president in 1969. The top tax tier was still $200,000, and as I mentioned above these people were taxed still at a 70% rate. A year later, the average income was about $8,200 a year. The average married couple filing jointly was taxed 22% in 1970. These Republican presidents, like Eisenhower before them, were pretty consistent about taxes, and not shy asking the wealthiest among us to pay more.

And of course let's not forget the Vietnam War was a huge expense throughout the 1960s and early-to-mid 70s. I'm starting to see a pattern. Have I mentioned war is expensive? Oh yes-- I think I did.

Democrat Jimmy Carter's administration raised the income tax tier slightly so by 1980 it was $215,400. Under Carter, a married couple filing jointly who made under $3,200 a year paid zero taxes. Carter was the first president in the past 100 years to have a zero tax rate for the very poor. The 70s were a dark time in our history. Not only was there horrendous inflation, but simply awful disco music, hair styles and clothing (including the foul and horrific "leisure suit" for men). I shudder to remember.

An actual catalog advertisement from a JCPenney catalog from the 1970s. Terrifying.

Here's where this whole tax rate thing gets really interesting, at least to a middle class person such as myself. I will warn all Reagan fans right now that I have a huge problem with the changes that the 1980s brought to the tax structure of our nation.

Under the Reagan administration, the top tier taxable income goes haywire. Since a picture is worth a thousand words, let's take a look:

The Reagan Years: Highest Income Tax Tier in Thousands of Dollar$

This chart shows jumps all over the place. It's where it lands that captured my attention. Percentage-wise in 1988, people who were making $29,750 annually were viewed has having the same tax responsibilities as someone making $10 million. Or more. WAKE UP!! That should really open your eyes, if you've been dozing off!!

Then there's the tax rate itself, for those in the top tier:

Top Tax Rate on Regular Income under Reagan (percentage)

What do these graphs show together? As stated above, a married couple making $29,750 was suddenly in the top tax tier along with millionaires & billionaires. And they both were taxed at a rate of 28% a year. If you made less than $29,750, the tax rate you paid was 15%. There were 2 brackets-- that's it. Simplicity. Fairness.

But in reality? This was the first time a US president had reduced taxes on the wealthy while simultaneously increasing taxes on the poor. No wonder the rich fall all over themselves for Reagan! A 28% marginal income tax rate must have seemed like a dream come true! I get it now!

The problem here to me is fairly obvious. If you were making $29,751 in 1988, your bills were predominantly about paying your rent/mortgage, feeding your family, making car payments, clothing the kids, heating/cooling your home, etc. The basics. The average price of a new home had skyrocketed to $91,600. A new Ford Taurus cost $9,996. Interest rates on loans (like mortgages) were over 10%. Life was expensive. I remember it well.

The 1980s!

The wealthy on the other hand, had all these ordinary needs squared away. The Reagan tax break allowed for an even more luxurious lifestyle. Believing someone making under $30K a year should have the same tax rate as someone making $100K, $1 million and billionaires is beyond comprehension. It's absurd.

Prior to 1988, the Reagan tax structure was friendlier to the poor. Keeping with the Carter policy at first, the very poor paid zero federal taxes. There were still 15 tax brackets in 1986. By 1987 there were only 5 brackets. Then 2 brackets in 1988.

In all fairness to Reagan, if you were a middle class tax payer in the 1980s making over $30K a year, the new tax code was helpful. The inflation of the 1970s made the tax burden very difficult for the middle class. Salaries went up for this group in the 70s, but with these increases came new, higher tax brackets. The expense of everyday living was difficult with sky-high prices on goods and services. The considerable Carter-era tax burden was very tough on people who were getting no bang for their purchasing buck. But Reagan gave the largest tax breaks by far to the well-to-do. The struggling middle class was thrown a little bone, though.

I should also mention that Reagan increased the capital gains tax in 1987 to the same rate as the personal income tax rate, 28%, from the previous rate of 20% in the early 80s. What does that mean? It means people who were fortunate enough to have profits from the stock market were taxed at the same rate as their income. Capital gains profits traditionally had been taxed at a much lower rate than regular income.

This looked fair and equitable in many ways. But if you look back-- and it's all a matter of public record-- from 1970 to 1978 the top capital gains taxes had been well over 30%. It's just that the personal income tax was considerably higher during those times on most people as well. Reagan lowered the personal income tax rate, then matched the capital gains tax giving the illusion that all was fair. Again, the rich love Reagan for a reason. In comparison to previous rates, both were beyond great for them! And the middle class had their little break to lull them into a sense of fairness.

Democrats argue that Reagan did raise taxes some ways: he attempted to close loopholes for tax-evaders and removed some tax breaks. He signed a law relative to taxing social security benefits on those with high incomes. He raised taxes on cigarettes. He got rid of the real estate deduction loophole. But I agree with the starry-eyed Republicans relative to Reagan's taxes-- they went down. Without question. I'm just not quite as wowed as they are with that fact, or maybe I am, but for an entirely different reason. According to Politifact.com from a 2012 report, "it’s accurate to say Reagan increased levies during five years of his administration, but there’s a caveat: The overall tax burden on businesses and individuals went down during his presidency."

This income tax structure set a precedent that is not sustainable for a nation that has a penchant for going to war. It was created by a president who believed that giving huge tax breaks to the rich would ultimately benefit everyone. Including the middle class and poor, when the money would-- in theory-- eventually 'trickle down' to them. It never did. All it did was make the rich even more rich, and left the middle class and working poor with the same tax burden percentage-wise as the wealthy.

Interestingly, Reagan's VP George H. W. Bush described Reaganomics as "voodoo economics" while trying to win the 1980 presidential nomination. Reagan is associated with small government & spending, but that was not the reality. He expanded the military enormously, spending money hand-over-fist on it to outdo Russian leader Gorbachev. In 1980, the public debt was $712 billion. In 8 years it had nearly tripled to over $2 trillion. For a president associated with reining in government, ironically the number of federal employees increased by 324,000 people from 1980 to 1988. That's over 6%.

It's my opinion that this precedent-- the one of giving huge tax breaks to our nation's wealthiest-- haunts us as a nation to this day.

George H. W. Bush did raise taxes slightly in 1991 to 31% for the top rate on regular income. Under his administration the highest tax tier rose to a slightly more realistic $82-86K range. Effects of Reaganomics were felt during the Bush administration when the poverty level increased.

When Democrat Bill Clinton won the presidency in 1992, the top tax rate on regular income climbed to 39.6% for those making $250,000 and more. Under Clinton, the top tier climbed to just under $300K per year. By 1993, 5 tax brackets were back in place. People making under $37K/year had the lowest tax rate of 15%, which offered relief to many. People making between $37K-89K a year, a substantial portion of the middle class, kept the Reagan tax rate of 28%.

Compared to the 40 years before Reagan, taxes during the Clinton Administration were very, very low. Clinton even lowered the top tax rate on capital gains to a low 21.2%, a really nice little gift for those doing well in the stock market. This once again benefited those with the most money. But it also helped retirees living off of their savings investments though, keeping their taxes low.

Taxes overall have remained very low ever since the late 80s and early 90s, especially for the wealthiest among us. Even Reagan's early 80s administration taxed regular income at a 50% rate until 1986. Thirty years ago, everything changed. The wealthy have adjusted to paying a lot less over this span of time. And because of this they have kept a lot more money than ever before, under Democrats and Republicans alike.

Clinton left the White House with the deficit erased, and the nation had a surplus of money. Not getting into war really seems to make a difference, doesn't it? Clinton also left the White House with the smallest federal workforce in decades, according to records from the Office of Personnel Management, OPM.gov . Don't believe me? Click on the link and look it up!

Under Republican George W. Bush, we went to war. We have seen how every single previous president paid for wars-- by raising taxes on everyone. Especially the wealthiest of our citizens. Not this time. While military spending sky-rocketed, taxes stayed low and capital gains taxes took a nosedive. People with investments in the stock market made & kept more money since Herbert Hoover's presidency. George W. Bush's lowest rate of 15.4% on capital gains even outdid Clinton's lowest with a 29% reduction on an already low rate. Incredible.

To Bush's credit, the poorest among us were given a real tax break in 2002, when the marginal tax rate for couples filing jointly making $12,000 or less saw their tax rate drop to 10%, a break compared to the Clinton & Reagan eras. When you're in that income bracket, every cent matters. By 2008, anyone making under $16,000 a year was in the 10% tax bracket.

During the Bush years, our country spent a ton of money. The financial cost of the Iraq war's first 7 years alone totaled just over $1.1 trillion (according to the Watson Institute of International Studies at Brown University). As of March of 2013, that the cost has been more accurately estimated at $2.2 trillion. I'd put in all the zeros & commas, but it's frankly easier to write the word "trillion' than to keep track of them all. This is just the price for the war itself. It does not include any medical bills for our hundreds of thousands wounded and traumatized vets.

Did President Bush raise taxes even the tiniest bit to help pay for the wars (note the plural; I've only been highlighting the Iraq War) during his administration? No, he did not. President Bush kept taxes down at an even 35% top tax rate from 2003 to 2008 for anyone making over a salary in the $300K+ range.

Social Security had a surplus of cash that was 'borrowed' from to pay for part of this war. Many Democrats think this cash was in essence stolen, but that's not accurate. We just went into debt. But unlike previous generations, the wealthiest in our land were asked to sacrifice absolutely nothing during this time period. My husband & I are not wealthy, but we were asked to sacrifice absolutely nothing during this time period. The poorest among us were the ones who were predominantly sent to war. Great and life-altering sacrifices were made in the battlefield.

My family & I visited the gorgeous Caribbean island of St. John in 2006. Not exactly a sacrifice. Here we are snorkeling, sacrificing absolutely nothing.

In terms of human loss, the war in Iraq has cost the lives of approximately 4,500 members of our military. Hundreds of thousands of our vets have sustained life-altering injuries. As of 2013, this war alone has killed at least 190,000 people-- the majority being Iraqi civilians-- according to the Watson Institute of International Studies at Brown University. That should be jarring to anyone reading this.

And I haven't even touched the costs of the Afghanistan War, in either dollars or human life. Or the lost opportunity for those who sacrificed so much. Or the financial bailouts in terms of money. By President Bush's last day in office we were over $10 trillion in debt. But at least our taxes didn't go up. Mission accomplished, at least in that department.

What does that reveal about us as a society? For me it reveals that we want the wealthy to be protected at all costs. Part of the reason that The Hunger Games series by Suzanne Collins resonated for me was that it isn't as outlandish at it seems at first. The wealthy are getting wealthier, and gaining more and more control of our politicians in the process. It's about what money buys: ultimate power. And that makes the Hunger Games books/movies all the more terrifying.

You can read more about how the wealthy are protected in an article from a June 4, 2015 article from the The Washington Post. For more, click on its title: "As the Rich Become Super-rich, They Pay Lower Taxes. For Real."

Democrat Barack Obama became president in 2009, and inherited a hot mess. Since the day he walked into the White House, I have heard Republicans moaning about the deficit, and all the reckless spending Obama has done. I am constantly stunned by this. It's like if someone owned a house, trashed it, got a double mortgage on it at a really high rate, and then dumped it all-- mortgage, mess, lock, stock and barrel-- on a new owner. And then all the friends of the original owner said, fix this up right now. Do it quickly, but don't spend any money trying to improve anything. Just do it. Incredible.

Since Obama became president some disturbing tax-related issues have arisen. The tax interests of big business took an historic turn in 2010 when Democracy was in effect sold. Under the 2010 Citizens United Supreme Court ruling, now corporations and unions can make unlimited political donations to the candidates that best represent their interests. Corporations legally became 'people' under the guise that their monetary donations to political campaigns are the equivalent of free speech.

Justice Ruth Bader Ginsburg has actually called this the Supreme Court's "worst ruling," stating, "I think the notion that we have all the democracy that money can buy strays so far from what our democracy is supposed to be." The voice of the average American is increasingly being drowned out by the wealthy and big business, who can wildly outspend the average person relative to political campaign contributions and advertising.

Here's one place President Reagan & I agree on something:

“Politics is supposed to be the 2nd oldest profession. I have come to realize that it bears a very close resemblance to the first.”

As for income tax on individuals, President Obama offered more tax relief than Presidents Bush, Clinton, Bush or Reagan for the poorest among us. By 2013, couples filing jointly making $17,850 or less were asked to pay the lowest rate, 10%. He increased the top rate on regular income from 35% to 39.6% for people making more than $450,000 a year in 2013, with a lot of opposition from Congress. For Obama's first 4 years as president, capital gains taxes dropped to a record low, even beating George W. Bush's insanely low rate. Then in 2013 the rate jumped up to 25%. Taxes are still very low, however, when held up against the rates previous to 1987. The deficit, however, is not exactly low.

It's like pre-Reagan tax history doesn't exist, or few remember it. I certainly didn't know about taxes in the last century until very recently. It's time for people to know how past presidents--both Democrat & Republican-- handled expenses and taxes. In the past, the wealthy were much less idolized. To be sure they've always been admired, envied and seen as celebrities. But they weren't government subsidized like royalty.

But is it fair to ask more of the wealthy? Yes. Historically we have asked more of the wealthy. That is very evident from the chart above. If that's not enough, here's one more reason among many: According to the Economic Policy Institute, the average CEO compensation in 2013 was $15.2 million, up 21.7% in a mere 3 years. From 1978 to 2013, CEO inflation-adjusted compensation a staggering increased 937%!! The average CEO now makes over 200 times what the average worker makes (click on glassdoor.com for more information on literally hundreds of large companies). It's good to be super wealthy!

The illusion is that these "job creators" deserve this. The average worker's inflation-adjusted compensation increased 10.2% over the same time period. Chances are that if you're reading this, that's more your situation than that of the super wealthy.

According to theHill.com in 2014, 2.4 million American jobs have been shipped overseas over the past 10 years. Why? So corporations can get cheap labor. And to add insult to injury, did you know that American companies can deduct the costs of moving operations overseas from their taxes? That's a money saver. When American company Burger King merged with Canadian company Tim Horton's, its "official" address became Canadian for the express purpose of saving tax dollars. The rich get richer. And the beat goes on.

Ross Perot, 1992 & 1996 independent presidential candidate for the Reform Party & billionaire, favored increasing taxes on the wealthy. He once said, "Makes no sense for me to pay less of a percentage of my income than other people." He knew he was rich, he knew he had enough. How refreshing! I personally wouldn't know, but I imagine there comes a time when having $1 billion is no different than having a quarter of that.

Some argue that if the rich are taxed like they once were, they'll lose their motivation. What nonsense. At the same time, these very same people often say the working poor should just pull themselves up by their bootstraps, even if they're working 2 full time jobs at minimum wage. They just can't figure out why someone doing that should lose heart. America is the land of opportunity! The poor just need to try harder!

America IS the land of opportunity, I still believe that. But it's undeniable that over the past 30 years the wealthy are the most favored class in our nation. Forgive me if I'm not weeping for the wealthy at the thought of them contributing more money through taxation. What motivates the rich isn't merely more money. If that were true, they would retire earlier than they do. At some point monetary excess becomes meaningless when you already have everything you ever dreamed of and more. As the late co-founder of Apple & billionaire Steve Jobs said, " If you do something and it turns out pretty good, then ....go do something else wonderful, don't dwell on it too long. Just figure out what's next."

Life isn't going to change all that much, one way or another give or take a few million or billion dollars if you're already filthy rich. But imagine whose lives could be changed by the wealthy contributing more to our nation than they do now. Just imagine.

It is fair to ask the wealthy to pay more. This can still be a nation where people strive for greater financial success. But wealth for a select few must never come at the expense of the people who are the majority of America. With great privilege comes great responsibility. Or at least in the movies, anyway.