An interesting business development transpired this week. You may (or may not) have heard that pharmaceutical giant Pfizer, known for tons of prescription drugs including Viagra, Lyrica, Lipitor and Chantix as well as over-the-counter drugs such as Advil and Robitussin, had planned to leave the USA-- well...at least on the books.

The plan had been for Pfizer to merge with Irish-based Allergan-- known for making many generic drugs as well as name brands like Botox and Restasis-- in order to save on their corporate tax bills. On Wednesday news that the deal fell through hit the presses.

So what's going on? And why should you care? Pfizer's plan had been to acquire smaller "Irish-based" company Allergan, then change its bookkeeping address to Ireland too. The actual business would have remained here in the good old USA though, because Pfizer planned to continue usage of American infrastructure, technology, research, workers and patent laws. Since Ireland's corporate taxes are lower than ours, this would have been a big money saver for Pfizer.

Both these companies are part of the S&P 500 I mentioned in my previous blog post. If you click on the link and look for Allergan, there's the stock! And look where it's headquarters address is: Dublin, Ireland. US headquarters, however, are in Parsippany NJ, and distribution headquarters are in Weston, FL. Their website lists its primary contact phone numbers to area code 862, which is in NJ. Why the headquarters is in Ireland becomes blatantly obvious when you really examine the situation.

On Tuesday, President Obama said new Treasury Department and IRS rules would help prevent companies from taking advantage of “one of the most insidious tax loopholes out there, fleeing the country just to get out of paying their taxes.” " And it seems it's working, if this Pfizer/Allergan deal's failure to launch is any indication. Rachel McCleery, a Treasury Department spokesperson stated, "We tailored our earnings stripping rules to focus on abusive practices, not genuine investment in our country. Businesses that are investing in American workers and infrastructure will not be penalized by these regulations."

President Obama further stated, "That lost revenue (money saved by the wealthy and large corporations not paying their share of taxes) has to be made up somewhere" in order to run our nation. That "somewhere" includes middle class families. Like mine. And small business owners, who employ a huge number of American workers.

The kind of sleazy move Pfizer and Allergan were attempting is what is known as a corporate inversion. It's one of many business tactics that I view in essence as the old dine-and-dash. A dine-and- dash is when people get up and quietly exit a restaurant without paying their tab. It leaves business owners and honest customers to cover the costs of this behavior. Someone else has to pick up the tab, one way or another.

Big dog, little dog: the rules are the same! (Lightning with Rupert, 2006)

Corrupt as it sounds though, often business tactics like this are perfectly legal due to poorly written laws. So it's not really analogous to a dine-and-dash. It's more like certain customers are deemed more special than others, and are allowed to dine-and-dash while paying customers and small business cover everyone's bills. Big businesses and wealthy people have tons of accountants and lawyers to figure out the best way to avoid paying taxes. These privileges are not exactly something available to 'regular' people-- or small business owners.

Issues like this should matter to average American workers who pays taxes on hard-earned income. Forcing large wealthy companies to play by the same rules as individuals is reasonable. I'd go so far to say it's obvious!

Pfizer backing out of the deal with Allergan did not go over well with Brent Saunders, CEO of Allergan. He has gone so far to say the Treasury Department was acting in an "un-American" way, and that the Pfizer/Allergan deal was targeted by the Treasury Department. Mr. Saunders said in an interview, "the rules are focused on the wrong thing: Our government should be focused on making America competitive on a global stage, not building a wall locking companies into an uncompetitive tax situation."

Scare tactics such as these abound, as in a declaration from president of the Organization for International Investment (A non-profit! Believe it or not!) Nancy McLernon, who according to Fox Business said that the new rules would "put at risk the jobs of 12 million American workers." That sounds more like a thinly veiled threat and blatant fear-mongering than anything else.

I guess what I personally view as American vs. un-American is a little different from Allergan's CEO. I believe that American corporations should stay in America and operate by the same rules as the average citizen. But overall, the ones who ship their business overseas have been reaping higher rewards instead. I'm all for big business doing well (really well even!)- but NOT at the expense of those of us who don't have special loopholes created just for them.

These 2 big dogs (Hermione & Digory) knew how to play fair, even with their much smaller brother Howie the cat. It wasn't even an issue-- it was simply the way it was and they always lived up to my expectations.

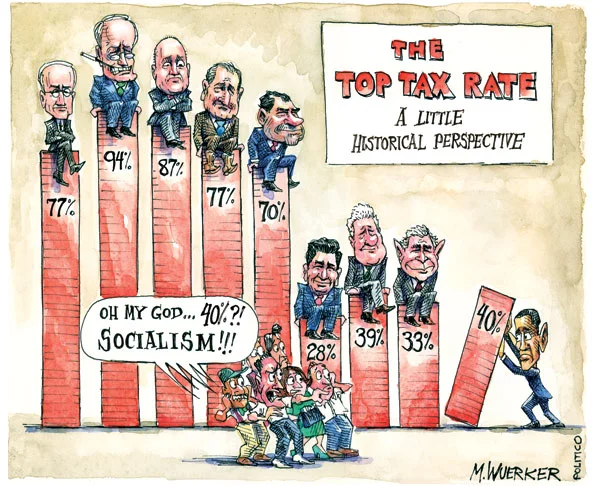

Interestingly, according to FoxBusiness.com, "The Obama administration and congressional Republicans actually agree -- and have for years now -- that the U.S. should cut its corporate-tax rate, make it harder to push profits out of the U.S. and remove the incentives to stockpile profits abroad." In fact President Obama wants to decrease the corporate tax rate from 35% to 28% (lower even than Republican hero Ronald Reagan's corporate tax rate). Wait-- what? So what's going on?

It gets confusing. Senator David Perdue of Georgia (R) actually said large corporations "aren't companies that are led by mean, greedy CEOs. These are people making good decisions based on our current tax law." Hmm...something just doesn't add up. It would seem the top 1% in this country is somehow being favored. Again. Let's look at corporate salaries, shall we? CEO Ian Read is doing fine, thanks for asking. According to the Wall Street Journal, Read's 2014 pay package was $23.3 million. In 2014 Mr. Saunders of Allergan was compensated with a little over $21 million. Somehow there's all kind of money to pay the top dogs in these companies, yet the average American worker is at risk of losing his/her job? Wow-- this is really insane.

While speaking to the press earlier this week, the President said that only Congress can close tax loopholes enjoyed by large corporations, but there is limited interest in changing the laws to protect the super wealthy. Gee, I wonder why? Perhaps it's because big business can funnel money to campaigns for the politicians who'll protect their interests. Corporations are people now, remember? The Supreme Court ruled that with Citizens United. It's all legal! It boggles the mind.

This blog is about investing for the future. You may be wondering-- do we, as in this household, own any stock in Pfizer? You bet. It's tucked away in mutual funds in our 401Ks and IRAs: it's in a few Vanguard, TIAA-CREF, T. Rowe Price funds we own, and pretty much any index large cap fund you can mention. And Allergan? Yep. Got that too. It's in similar mutual funds, and-- you guessed it-- many index funds. We own neither as individual stocks.

If you've got IRAs and/or a 401K, I've got news for you: odds are really high you own these companies too, and probably don't know it. And undoubtedly like you, I do in fact want these stocks to do well and make money for our retirement. Just not at the expense of the average American taxpayer. Which ironically is me, and probably you.

Before I go, and before you cry a river for these 2 misunderstood corporations, Pfizer's stock price went up Wednesday, April 6th by a whopping 5% to nearly $33.00 per share. The past year has been a rocky road, with a high in August 2015 of $36.15 per share, to a low of $28.56 in February this year. Allergan has had rockier road over the past year (again, highest in August 2015, with a big drop just days ago when the deal with Pfizer fell through). But it's stock also went up nearly 3.5% just April 6th.

Let's see what tomorrow and the next few months bring, shall we?